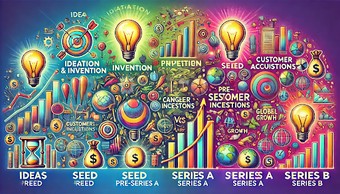

Show Me the Money: A Simple Guide to Startup Funding Stage. Venture Funding Lifecycle

Muhammadaziz Odilov

Let's talk about money when you have a great idea to start a venture. There is actually no standard form of funding rounds that startups follow as it all depends on their capital need capacity and willingness to give up some equity for money. But I will tell you some general funding rounds and how they look from the perspectives of startup founders.

Ideation & Invention: A time you come up with a great idea and start working on it (Brainstorming). You basically bootstrap at this stage (use your money). You might do a customer discovery at this stage by testing your assumptions about the pain and the market.

Pre-seed (Validation): That's where you build a prototype of your solution to see market realization and validation of the solution you are working on. You can join accelerator programs, do crowdfunding, or pitch to angel investors or VCs and give them equity in return for capital (typically max 15%). You can raise from $100k- $1 mln based on the capacity and the need of the startup.

Seed (Creation): After you have seen that people are interested in your solution (market validation), you begin to build your product (demand and customer acquisition) to increase volume and better service (repeatable MVP for more customers in the regional market) and use the money in the seed capacity to dominate the market. Raise > $1 mln. If you have an angel or VC backing you up from the pre-seed, ask for a follow-up investment or referral. (easy to raise at this stage)

Pre-Series A, Series A (Growth): You start scaling at this stage which is sort of an MVP for other markets (if the venture is in the Central Asian region then, after getting the Uzbek market, this capital can be used to scale to other Central Asian markets) or use the money for seed round purpose since the startup closed the seed round already. (Market expansion and Proving revenue model capital). Raise > $5 mln.

Series B (Rapid Expansion): Now that the startup product is validated in the local and international markets, this capital can be used to increase global visibility to any market possible or focus on the net expansion (Customers buying more than twice). Raise > $25 mln.

After the funding rounds of Series A mid or B, most companies are valued at $1 bln (unicorn) and possibly get exited with IPO or sold 🤑.

This is how venture funding works; although not clearly, this document will be helpful to really look into how this cycle works.

What stage do you think is the most challenging for startup founders and why

Comments